Understanding the First and Second-Order Effects of Tariffs

- Tariffs are back in the global economic conversation—and for good reason. As tools of both economic strategy and geopolitical leverage, tariffs have wide-ranging implications that go well beyond trade.

- In this post, we’ll walk through the first-order consequences of tariffs, the second-order ripple effects that follow, and the broader structural issues that make this topic especially relevant today.

First-Order Effects of Tariffs: The Direct Impact

At their core, tariffs are taxes on imports. But their impact runs deeper than that:

- Revenue Generation

- Tariffs raise revenue for the country that imposes them. This tax is effectively shared by foreign producers and domestic consumers, with the actual burden depending on the relative price elasticity of each.

- From a policymaker’s perspective, this makes tariffs an appealing tool.

- Tariffs raise revenue for the country that imposes them. This tax is effectively shared by foreign producers and domestic consumers, with the actual burden depending on the relative price elasticity of each.

- Loss of Global Efficiency

- By distorting price signals, tariffs reduce global production efficiency. Countries are no longer specializing where they have comparative advantage, leading to misallocation of resources.

- Tariffs artificially raise the price of imported goods. This distorts the real cost of production and consumption. As a result:

- Domestic producers in the tariff-imposing country may start making things they’re not good at, just because it’s now more expensive to import them.

- Global production shifts away from the most efficient producers and towards less efficient domestic producers.

- By distorting price signals, tariffs reduce global production efficiency. Countries are no longer specializing where they have comparative advantage, leading to misallocation of resources.

- Stagflationary Pressure

- Globally, tariffs tend to create stagflationary conditions—raising prices while dampening growth. They’re typically deflationary for the exporter (as demand drops) and inflationary for the importer (as costs rise).

- Globally, tariffs tend to create stagflationary conditions—raising prices while dampening growth. They’re typically deflationary for the exporter (as demand drops) and inflationary for the importer (as costs rise).

- Protection of Domestic Industries

- Tariffs shield domestic companies from foreign competition.

- While this might preserve jobs and help industries survive, it also reduces the pressure to innovate, making these businesses less efficient over time—unless supported by broader fiscal and monetary stimulus to maintain demand.

- Tariffs shield domestic companies from foreign competition.

- Strategic Value in Geopolitical Conflict

- In times of great power conflict, tariffs (and broader protectionist policies) can play a crucial role in preserving domestic production capabilities critical to national interest.

- In times of great power conflict, tariffs (and broader protectionist policies) can play a crucial role in preserving domestic production capabilities critical to national interest.

- Correction of Global Imbalances

- Tariffs can help reduce both current account (trade) and capital account (investment) imbalances.

- In simpler terms, they reduce overreliance on foreign production and foreign capital—something that becomes particularly vital during periods of geopolitical stress.

- Tariffs can help reduce both current account (trade) and capital account (investment) imbalances.

Second-Order Effects: The Chain Reactions

What follows after tariffs are imposed depends on a complex web of policy responses and market adjustments. These include:

- Reciprocal Tariffs

- If countries retaliate with their own tariffs, the stagflationary impact becomes broader and more entrenched across regions.

- If countries retaliate with their own tariffs, the stagflationary impact becomes broader and more entrenched across regions.

- Monetary Policy Adjustments

- Central banks may respond to tariff-induced economic changes by:

- Easing policy where deflationary pressures mount, lowering real interest rates and weakening currencies.

- Tightening policy where inflation spikes, raising rates and strengthening currencies.

- Central banks may respond to tariff-induced economic changes by:

- Fiscal Policy Shifts

- Governments may increase spending or cut taxes in countries facing demand weakness—or do the opposite to cool overheating economies.

- These moves can help neutralize the inflationary or deflationary forces set in motion by tariffs.

- Governments may increase spending or cut taxes in countries facing demand weakness—or do the opposite to cool overheating economies.

These second-order effects make it difficult to forecast market responses to tariffs without considering the entire policy mix—monetary, fiscal, trade, and currency—all of which can interact in unpredictable ways.

Impact on the U.S. Economy

- Domestic Industry Protection

- Trump’s tariffs aim to protect U.S. industries (like steel, autos, semiconductors) from foreign competition. This could:

- Help revive or preserve U.S. manufacturing jobs, especially in politically important states.

- Give domestic firms some breathing space to grow or invest in capacity.

- Trump’s tariffs aim to protect U.S. industries (like steel, autos, semiconductors) from foreign competition. This could:

- Higher Input Costs

- However, U.S. companies that rely on imported materials or components (e.g., auto and tech firms) may face higher costs, which could:

- Lower their profit margins

- Lead to higher prices for consumers.

- Make U.S. exports less competitive abroad if production costs rise.

- However, U.S. companies that rely on imported materials or components (e.g., auto and tech firms) may face higher costs, which could:

- Inflationary Pressure

- As tariffs raise the prices of imported goods, the U.S. could experience:

- A moderate rise in inflation.

- Pressure on the Federal Reserve to manage interest rates accordingly.

- As tariffs raise the prices of imported goods, the U.S. could experience:

Effects on Other Countries

- Export-Dependent Economies Get Hit

- Countries that heavily export to the U.S. (like China, Mexico, or Vietnam) could see:

- Reduced demand for their goods.

- Slower GDP growth if exports form a large part of their economy.

- Countries that heavily export to the U.S. (like China, Mexico, or Vietnam) could see:

- Global Supply Chain Disruptions

- Many modern products (like electronics, cars) rely on global supply chains. Tariffs could disrupt these networks, forcing companies to:

- Relocate factories or reorganize sourcing.

- Incur higher operational costs during the transition.

- Many modern products (like electronics, cars) rely on global supply chains. Tariffs could disrupt these networks, forcing companies to:

- Risk of Retaliation

- Targeted countries might respond with reciprocal tariffs, impacting U.S. export.

- This can lead to trade wars, with mutually harmful effects.

- Targeted countries might respond with reciprocal tariffs, impacting U.S. export.

Where does India stand

- Before the reciprocal announcement, the U.S. tariff rates were among the lowest, with simple average tariffs at 3.3%, compared with India’s 17%, the White House said.

- Last week Reuters reported that New Delhi is open to cutting tariffs on U.S. imports worth $23 billion to mitigate the impact on its exports in sectors like gems and jewellery, pharmaceuticals and auto parts

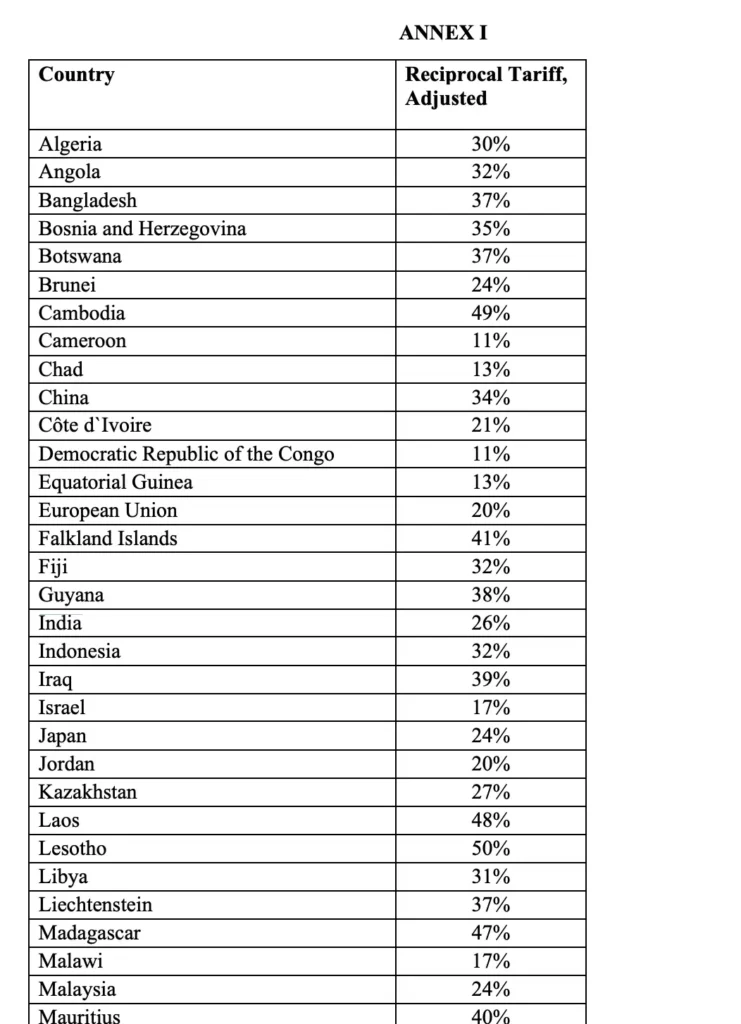

- The new tariff structure on Indian goods is as follows:

- Existing tariffs: 25% on steel, aluminum, and auto parts.

- New tariffs: April 5-8: A 10% baseline tariff on remaining Indian goods; April 9 onwards (now) 26% tariffs will apply to India-specific imports.

- Exempted sectors: Pharmaceuticals(Trump has mentioned he will get this sector in Tariffs as well), semiconductors, energy products (oil, gas, coal, LNG), and copper.

- Existing tariffs: 25% on steel, aluminum, and auto parts.

Short Term Pain, But India might Possibly gain

India Is Already the Lowest-Cost Producer

- India Is Already the Lowest-Cost Producer in Several Industries like:

- Generic pharmaceuticals

- Textiles and apparel

- Engineering goods

- IT services

- India has a cost advantage that is hard to beat—even with a tariff. Companies may still find Indian suppliers more economical than alternatives, especially when:

- Chinese imports face even steeper tariffs or political restrictions

- Sourcing alternatives like Vietnam or Mexico hit capacity limits or cost constraints

- So, even with tariffs, Indian exporters may remain competitive in net terms, particularly in high-volume, cost-sensitive global supply chains.

Tariffs Could Backfire on the U.S. Itself

- Tariffs are a double-edged sword. They raise prices for U.S. consumers and businesses that rely on:

- Indian inputs (e.g., generic drugs, auto parts, textiles)

- Indian tech talent and back-end operations

- This could fuel inflationary pressure within the U.S., especially if American firms can’t find viable substitutes. In some cases, U.S. businesses may lobby to carve out exceptions or reduce tariff burdens if the cost is too high.

India Could Gain Business from Other Tariffed Countries.

- India stands to benefit from trade diversion. Here’s how:

- If the U.S. is hitting China or other large exporters with even steeper tariffs or sanctions, buyers may shift to India as a more stable and friendly supplier.

- Global companies looking to de-risk their China exposure may accelerate their “China + 1” strategy, with India as a key alternative.

- India has the scale, talent, and policy momentum to step in—especially in electronics, chemicals, pharma, and engineering goods.

Final Thoughts

Tariffs are just one piece of a much larger puzzle. While their first-order effects are relatively straightforward, the second-order consequences—ranging from monetary and fiscal policy shifts to currency adjustments and reciprocal actions—make the outcomes complex and highly interdependent.

What’s clear is that we’re moving into a period where monetary, economic, and geopolitical orders must shift, and likely in dramatic ways. We’ll continue to track these developments closely and share thoughts as we navigate this volatile terrain.

Stay tuned.

Thank You for Reading

Bhavya Sonawala

Subscribe to our Newsletter,

Get latest updates, Propreitory Analysis and more.