Have been Invested and studying CCL Products for a while.

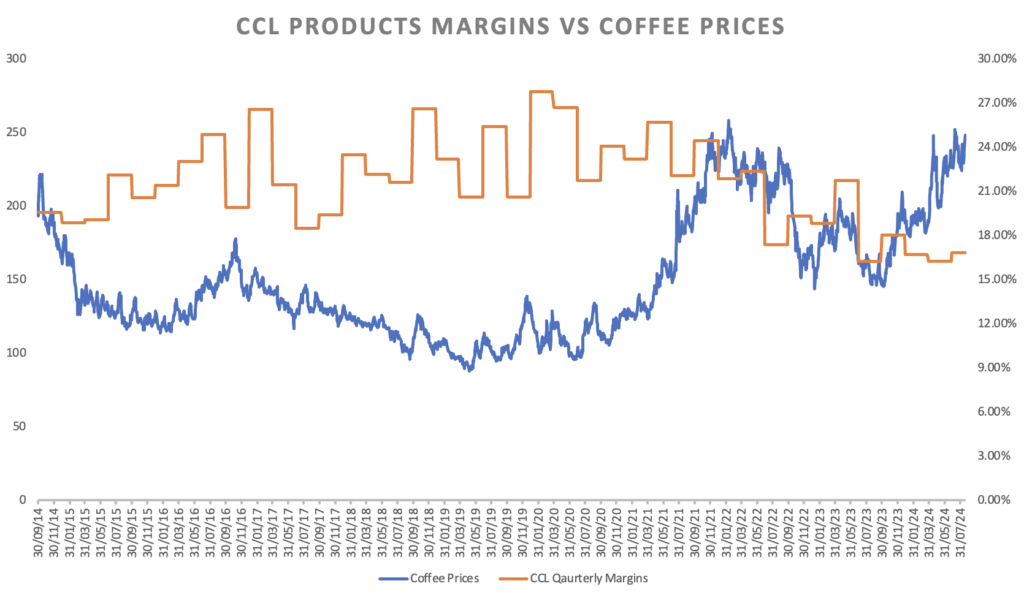

They have been mentioning how their margins look low / suppressed optically, when coffee prices increase, and Vise versa i.e when coffee prices are low, the margins optically look Expanded / High. They have a rather fixed EBITDA/KG and a price + model, i.e they source their raw material when orders are confirmed and add fixed margin. To show this I did a coffee prices to CCL Products map out in order to check how the trend looks like.

The below chart shows, CCL Products margins are at the lowest when coffee prices at the highest and Vice Versa. There seems to be a lot of Volatility in margins. But that does no necessarily mean real margins are volatile. Companies like CCL Products have a fixed EBITDA/KG fixed, and irrespective of fluctuations in raw material and intern end products. Aim of such companies is to either keep EBITDA / KG stable or grow them by either value added products, better manufacturing or various other methods.

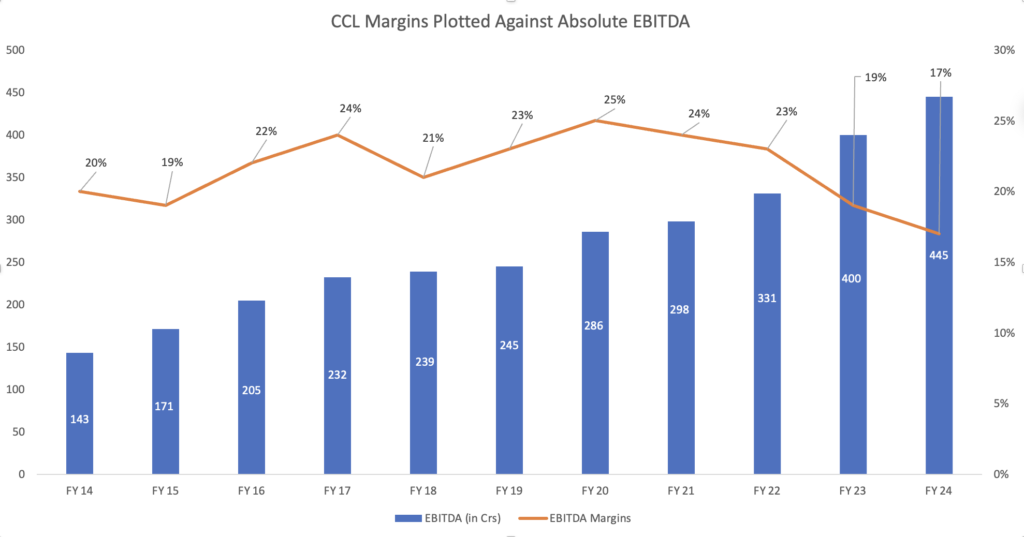

Another Chart here plots the CCL Products EBITDA margins with Absolute EBITDA. Irrespective of the fluctuating Margins, there has been a growing trend in their Absolute EBITDA. Hence, in companies which Follow Price + Model, as long as there is Volume growth, there will be EBTIDA growth, even though there margins look volatile.

Note – This is keeping other things constant, i.e no other extraordinary costs, shipping costs or other costs.

Found this to be interesting!