Industry Overview

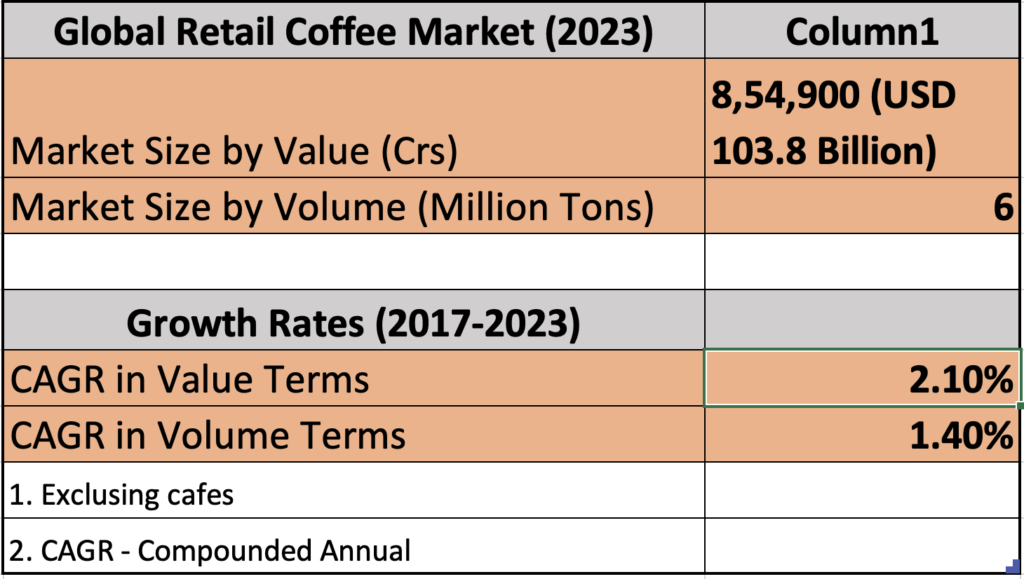

- In general, the coffee industry is an attractive, large and stable category, and one that is growing continuously in local currency terms and volumes and, as a rule, is not dependent on economic slowdowns.

- Growth was observed in most countries of operations in local currency and in volumes sold to retailers, despite the economic slowdown in 2020 in the wake of the COVID‐19 pandemic.

- Coffee industry has gone through various issues like, supply chain, container shortage, raw material fluctuation, economic crisis and covid, but has steered through each of this with ease.

- This resilient behaviour can be attributed to coffee being one of the most consumed beverage in the world for decades.

- There are two major types of coffee: Arabica and Robusta. The former is generally considered superior to the latter

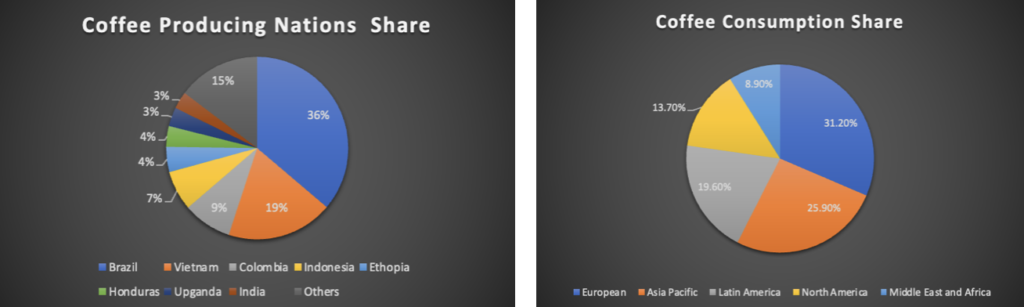

- Coffee is usually produced in developing countries and imported by developed countries.

- Brazil, Colombia, Vietnam, Indonesia, Ethiopia, India are amongst the biggest producers of coffee while the US, European Union, the UK and Japan are top coffee importers

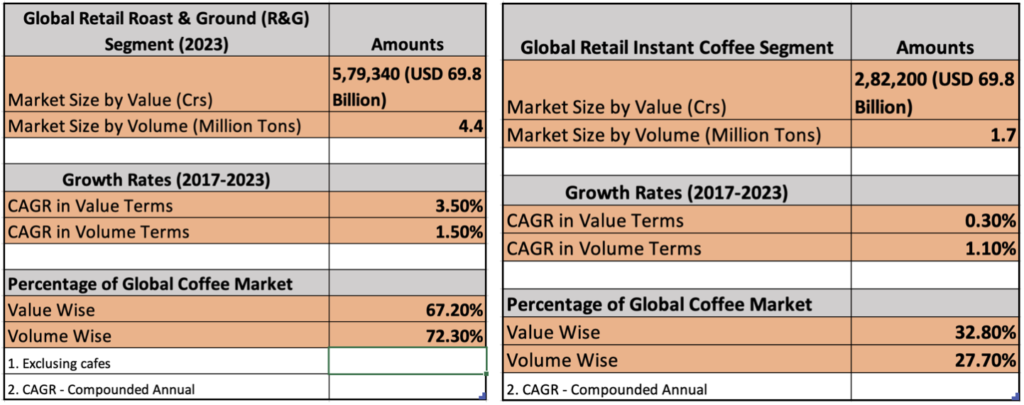

- Coffee can be diversified into Roast and Ground coffee and Instant coffee by the process or nature and can also be divided into Away from home consumption and At home consumption by way of consumption.

Consumer Trends in Coffee Market

- Away From Home(AFH) coffee consumption declined in 2020 due to pandemic restrictions on hotels, restaurants, and cafes, and reduced office presence.

- Premiumization trend in food and beverages, seen in wine, beer, and cheese, also impacted coffee culture.

- Pandemic boosted premiumization trend in at-home coffee consumption.

- Coffee consumers became more sophisticated, knowledgeable, and demanded higher standards.

- Trend towards product diversification with consumers switching between types of coffee (R&G, instant, espresso) even on the same day.

- Manufacturers adapting to coffee culture through up-to-date brands, strategic manufacturing, distribution chains, and leveraging food technologies.

- Opportunity for manufacturers to add consumer value, generate growth, increase margins, and mitigate risk from raw material volatility.

- New coffee categories such as single-portion capsules, roasted beans, ready-to-drink coffee, and hybrid instant coffee are growing rapidly.

Instant Coffee growth Triggers

- Rapid growth in global instant coffee market driven by ease and speed of preparation, coupled with high antioxidant content.

- Rapid Premiumization in Instant coffee making it’s Aroma and taste very close to Roast and Ground / traditional coffee brewing method

- Increased demand from coffee shops and restaurants worldwide contributes significantly to market expansion.

- Growth of the food and beverage industry plays a vital role in expanding instant coffee businesses.

- Consumer demand for easy-to-prepare food and beverages fuels the popularity of instant coffee.

- Growth spurred by the middle-class population in developing nations, such as India.

- Rise in disposable income in developing countries leads to increased consumption of instant coffee, contributing to global market growth.

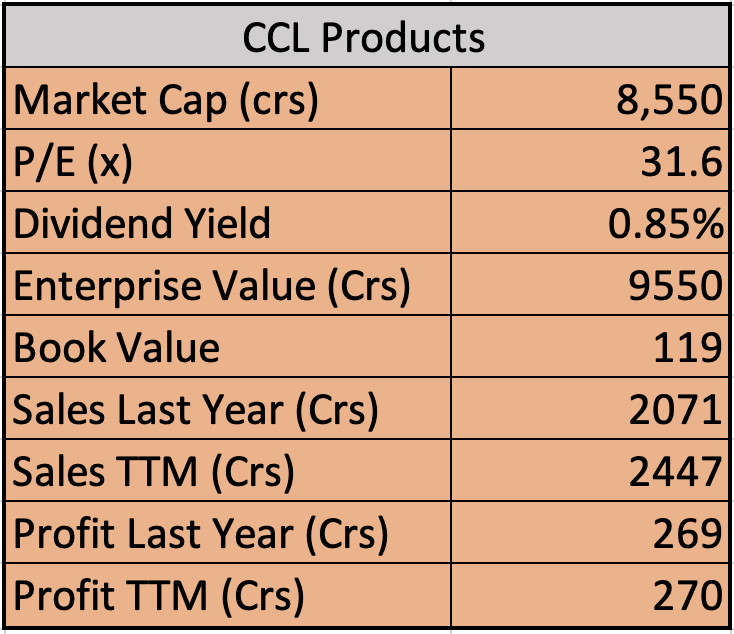

CCL Products (Continental Coffee)

- CCL Products (India) founded in 1994.

- Globally the largest private label instant coffee manufacturer.

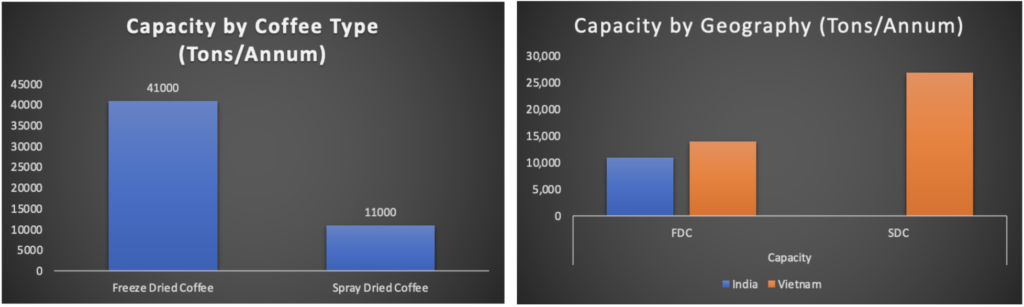

- Engaged in manufacturing soluble instant spray dried coffee powder, agglomerated & granulated coffee, freeze dried coffee, roasted coffee, roast & ground coffee, and freeze concentrated liquid coffee.

- Offers flavored, decaffeinated, organic, rainforest, fair trade, dual & triple certified, and chicory coffee mix as per customer specifications.

- State-of-the-art soluble instant coffee plant in Duggirala Mandal, Andhra Pradesh, with a current capacity of 20,000tn pa.

- India’s first freeze-dried instant coffee plant established in AP in 2005.

- Another freeze-dried coffee plant with a 5,000tn pa capacity in Chittoor district, Andhra Pradesh, set up in FY20.

- Additional 13,500tn pa unit in Vietnam, with plans to double capacity to 27,000tn.

- Total current capacity as of is 38,500tn, expected to reach 52,000tn in a year.

- Adopts Swiss & Brazilian technology for instant and soluble coffee production.

- Certified by British Retail Consortium (BRC) and International Food Standard (IFS) with quality management system (QMS).

- Achieved “Two-Star” Export House status.

- Certifications for organic, rainforest alliance, fair trade, Kosher, and Halal.

- Exports to more than 80 countries.

- Recognized for outstanding contribution to the global coffee market by various organizations, including the Commerce Ministry’s Coffee Board of India and the Andhra Pradesh government.

Capacity

Insights

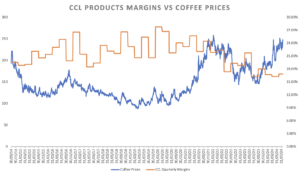

- CCL adopts a cost plus model. Coffee Beans are sourced after order has been finalised

- EBITDA/Ton stays almost the same making raw material fluctuations immaterial, but higher raw material price affects working capital

- It not only specialises in FDC and SDC but also has a basket for any needs of customers. This makes them one stop shop for coffee and also extends its strength by letting the customer choose its packing making it very lucrative for the customers

- CCL Products entered the branded business in India a few years ago and has made commendable inroads focusing on strong product and increasing distribution. Marketing spends are modest and yet results have been very strong.

- Branded business has crossed 200crs gaining market share in south which is a predominantly coffee drinking region : Andhra Pradesh and Telangana company has 7% market share while in Karnataka it has ~5% of share

- CCL’s competitive edge lies in the ability to create custom blends and packaging. Making CCL customers first choice and this had lead to stickiness with their customers

- CCL also offers small packs for its customers where margins are higher

- CCL avoids commodity risk by having both sales and purchase contracts on a back‐to‐back basis at fixed prices. Apart from this, company’s plant in Vietnam is at strategic location giving it easier access to raw material source and end markets. Vietnam brings in logistical cost savings, NIL duty structure for ASEAN countries and tax exemption.

- CCL Plans to add newer products in the premium range which will lead to an increase in margins.

- With a lot of new capacity which has come online and some yet to come online, operating leverage play will be significant going ahead

- CCL has demonstrated consistent relations with its customers by offering consistent blends for one periods of time.

- They are also well diversified in terms of Geography have export relations in 80 countries

- The instant coffee market has been growing at a mere 3-5% but CCL products has been growing upwards of 20% gaining market shares across the globa

- Inspite of such market share gains, there is a huge headroom left to grow as the market potential is big

- Opportunity going forward lies in Domestic as well as export. India has seen a lot of D2C brands coming with instant premium coffee, and CCL has been working with most of them. This growth in consumption should continue. CCL not only offers consistent blends, but also at a economical price for the customers, making the export market very attractive.

- Biggest opportunity lies in the branded business Continental Coffee. With a strong product and acceptance by mass, Continental Coffee can come a full FMCG Specialised in Coffee brand.

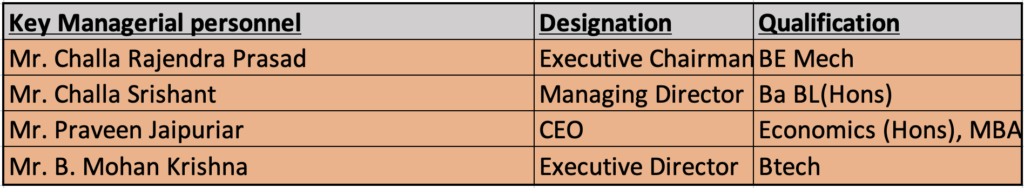

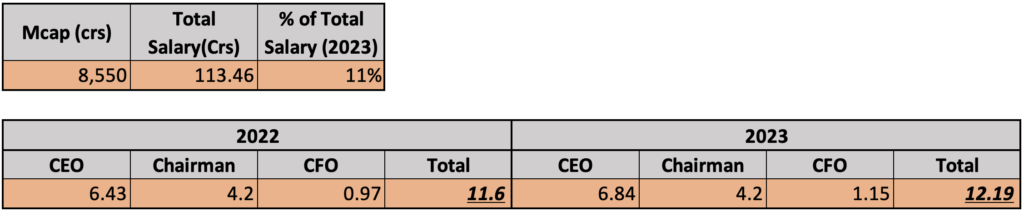

Management (KMP)

- The management of CCL has been technocrat led. Father son Duo have got the company from humble beginnings to a solid growth story.

- Praveen Jaipuria was pulled from Dabur and placed as the CEO, who also led Continental Coffee (brand)

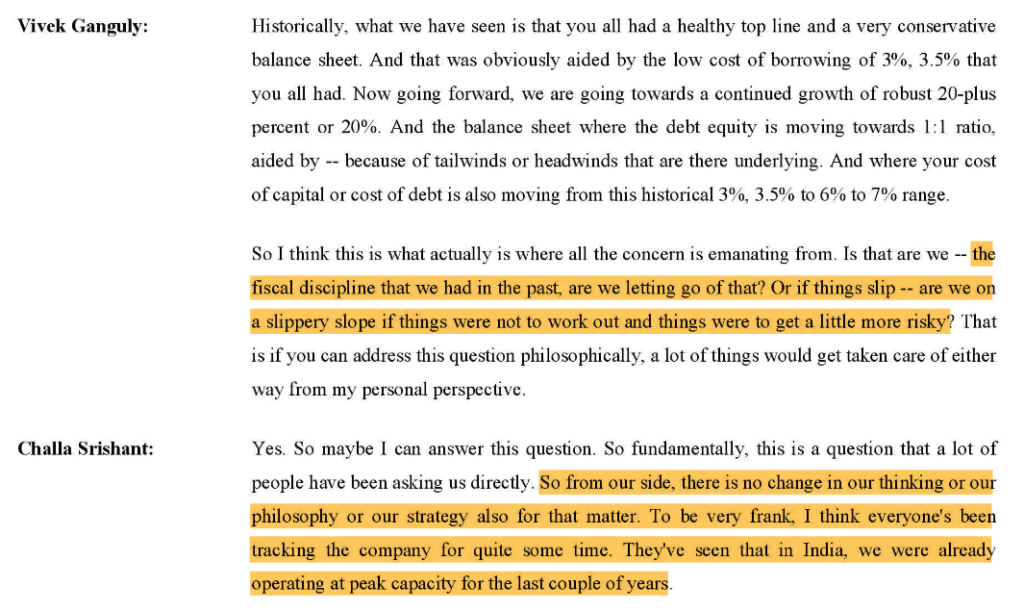

Snippets

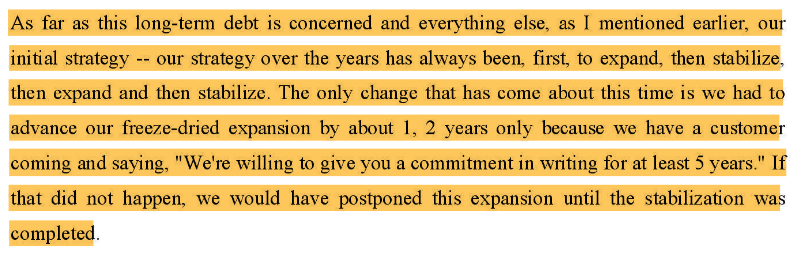

- Above Snippet just goes to show, CCL Products have known to always be prudent with funds, be it for marketing Continental coffee, or funds for expansion. Currently debt levels are high due to expansion because of the demand from customers

- Similarly, one customer is willing to give a commitment for 5 years for their Freeze Dried Capacity, again showcasing the strength of CCL products.

- In the above Video , the managing director talks about how they assemble their own equipments also have a division in the company to manufacture a few equipments. He also talks about the team they have built and the knowledge of many years of business which helps them not only be a low cost producer but also why customers are sticky and prefer CCL.

Raw Material and Relevant Issues

- The main raw material used in manufacturing instant coffee is green coffee beans. Approximately conversion factor, i.e. amount of green coffee beans required to manufacture instant coffee, stands at 1.6 i.e. 1.6kg of coffee beans are required to manufacture 1kg of instant coffee.

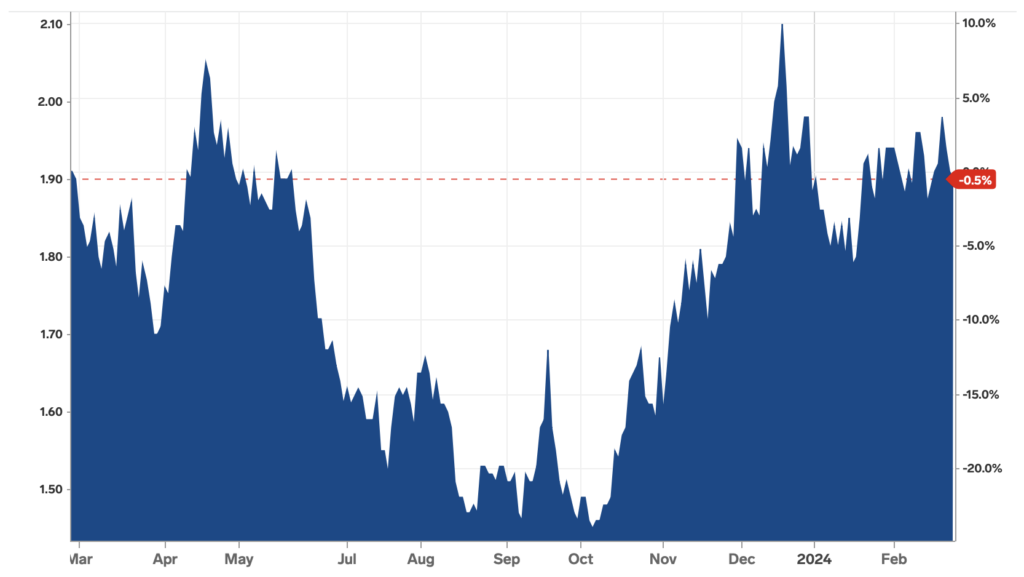

- Green coffee is a commodity traded on world exchange and hence its prices are most transparently like any other globally traded commodity

- As seen in the chart Green Coffee prices are very volatile. As CCL adopts a Cost plus model, EBITDA per ton is not effected, but volatility affects working capital. Higher green coffee prices will lead to higher value of inventory which needs to be serviced

- Large Capacities have come on stream which pose a risk, of the coffee cycle i.e demand drops and excess capacities can pose financial risk

- Red Sea ans any transport related issue can pose as a risk inters of delayed shipment, paying additionally for freight. Recently 40crs worth material was stuck as sea, posing delayed shipment reaching the customer

- Recently CCL’s Vietnam plant had a minor break down resulting in impact upto 5% of bottomline

- Exposure to export markets. Any geopolitical issue can hamper trade temporary or in extreme cases permanently

Financials

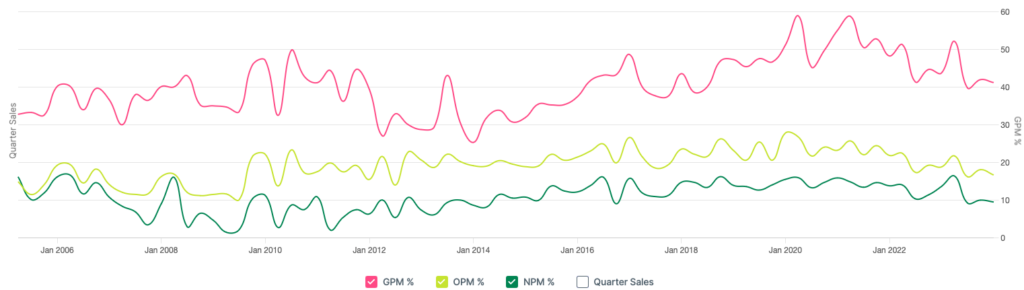

- Looking at the Financials, CCL products have been continuously growing for the last 10 years.

- They have managed to keep margins steady and inching up, except a few quarters or years here and there

- Guidance forward is to grow at 20-25% for 2-3 years.

Disclaimer

Disclaimer: The information provided here is not a stock recommendation, tip, or financial advice. It is solely for informational and educational purposes. Prior to making any financial decisions, it is strongly advised to consult with a qualified financial expert.

Sources

- CCL Products Annual Reports, Concalls

- Strauss Annual Report and Presentation

- Centrum Broking CCL report

- International Coffee Industry Report

Regards,

Bhavya Sonawala