About the Company

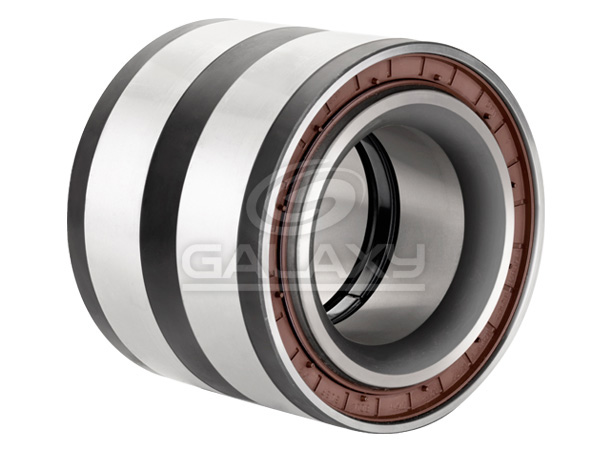

- Galaxy Bearings Limited started manufacturing Taper Roller Bearings & Cylindrical Roller Bearings in 1990 and so far have developed a variety of bearings to cater different market segments.

- Galaxy bearing specialises in manufacturing of Anti – Friction bearings used in wheels and Axle assemblies for applications such as container trailer, equipment carrier, port trailer, bulk tank and dump trailer

- Galaxy bearing also leads in manufacturing bearings for the motors and compressors industry which meets individual specifcations and tolerances

Bearing Industry

- What are Bearings – Bearings are used to keep parts from rubbing against each other as they move around. A bearing’s principal role is to transfer load between a rotor and the casing while minimising wear.

- Types of Bearings –

- BallBearing-The most prevalent form of bearing is the ball bearing. Everything from inline skates to hard drives contains them. These bearings can withstand both radial and thrust loads and are typically used in applications with low loads

- BallThrustBearing-Ballthrustbearingsaretypicallyemployedin low-speed applications and cannot withstand significant radial loads. This sort of bearing is used in wheelchairs.

- Rollerbearing-Rollerbearingsareutilisedinsituationswhere strong radial loads must be supported, such as conveyer belt rollers. The roller in these bearings is a cylinder; therefore, the contact between the inner and outer races is a line rather than a point

- RollerThrustBearing-Largethrustloadscanbesupportedby roller thrust bearings. They’re commonly found between gears and between the housing and spinning shafts in gear sets like automotive transmissions.

- Tapered roller bearing – Large radial and thrust loads can besupported by tapered roller bearings. Tapered roller bearings are commonly found in automotive hubs, where they are positioned in pairs facing opposite directions to handle force in both directions.

- Cylindrical roller bearing – Inner race, outer race, cage, and rollers are the four fundamental roller bearing elements of cylindrical roller bearings. The cage, which guides their rotating action on the flat surface, keeps the cylinder-shaped rollers equally separated.

Indian Bearing Market

- India currently contributes 5%( at USD 6bn )to the global bearing

- market, which has grown at 3-4% in the last 5 years.

- Bearings market is primarily dependent on the three sectors- Automobile, Aviation and Railway, which is ~60% of the total bearing demand.

- Capexup-cycleinbearinguserindustrieswillenabletheglobal bearing market to grow at 6-8% CAGR over the next 6-7 years (as per industry research). Additionally, MNC OEM bearing players are looking at global supply chain realignment, and thus India could reap the benefit.

- ForIndianbearingcomponentmanufacturers,TAM(Total Addressable Market) could grow at higher rate of 8-10% CAGR over the period (market share gain from China, which contributes 25% to global market)

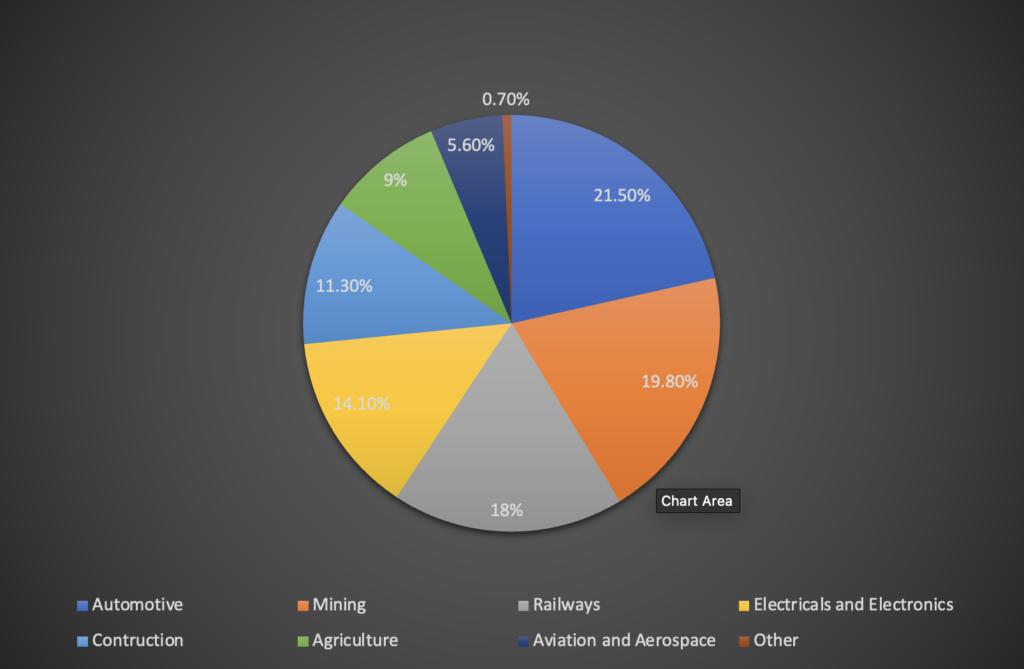

- Application of Bearings (Globally)

- It is estimated that more than 50% of the consumption of bearings in the country is met through domestic production. Meanwhile, less than 40% of the demand is met through imports and it has been declining due to increasing localization by multinational players operating in the domestic bearing industry.

More on Galaxy Bearings

- Galaxy Bearings Limited started manufacturing Taper Roller Bearings & Cylindrical Roller Bearings in 1990 and so far we have developed a variety of bearings to cater different market segments.

- Galaxy bearing specialises in manufacturing of Anti – Friction bearings used in wheels and Axle assemblies for applications such as container trailer, equipment carrier, port trailer, bulk tank and dump trailer

- Product Profile

- Taper roller bearings (Single and Double Raw)

- Cylindrical

- Wheel Hub Bearings

- Taper roller bearings (Single and Double Raw)

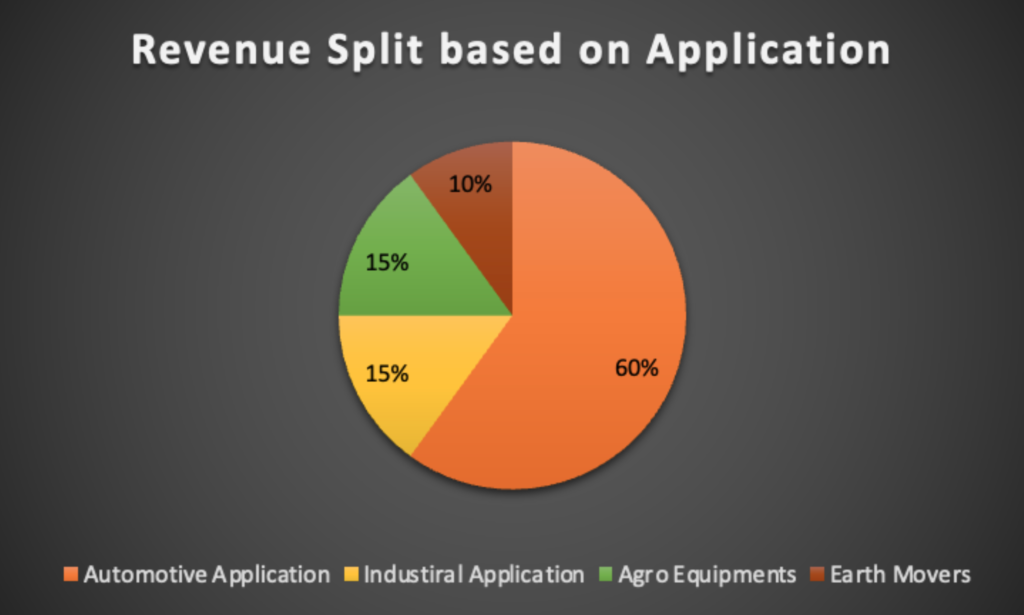

Applications of Galaxy Bearings Products

- CommercialVehicles

- Trucks, Trailers and Buses • Differential Bearings

- Gear Box

- Wheels

- Off Highway Vehicles

- Earth movers / Back-hoe Loaders

- Pick – n – Carry and Slew Cranes

- Vibratory Rollers

- Agricultural

- Tractors

- Combines and Harvestors

- Rotary Tillers

- Agricultural Machinery

- Industrials

- Steel plants / Rolling mills , Mining Equipments, crushers and pulverisers

- Stationery Diesel Engines and Gensets

- Motors and Compressors

Plant

- 7 State of the art manufacturing lines

- 2.5 Million Bearing per Annum capacity

- Plant Location – Rajkot

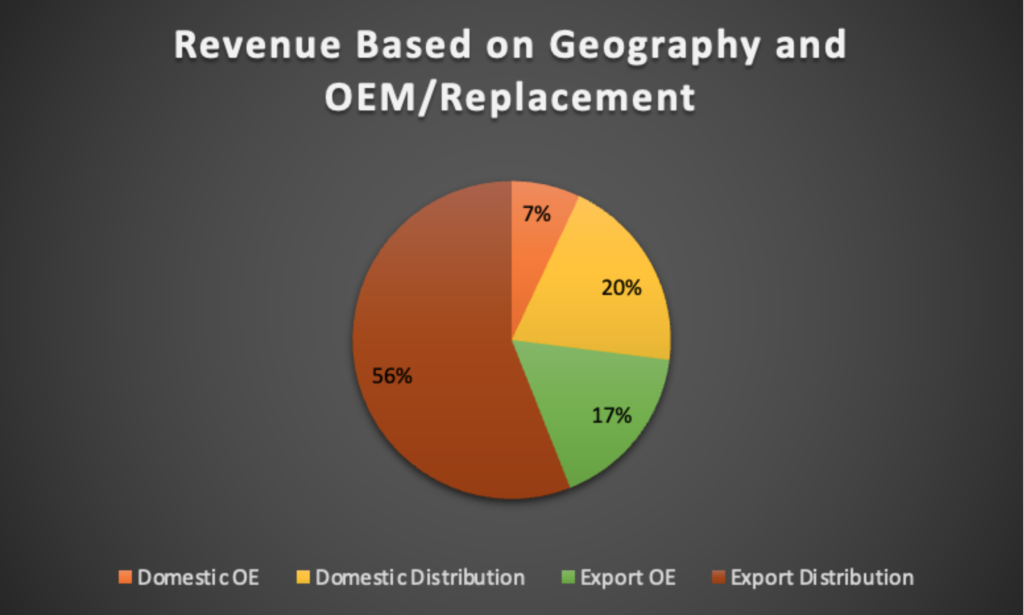

Revenue Split between Domestic / Export and OEM / Replacement

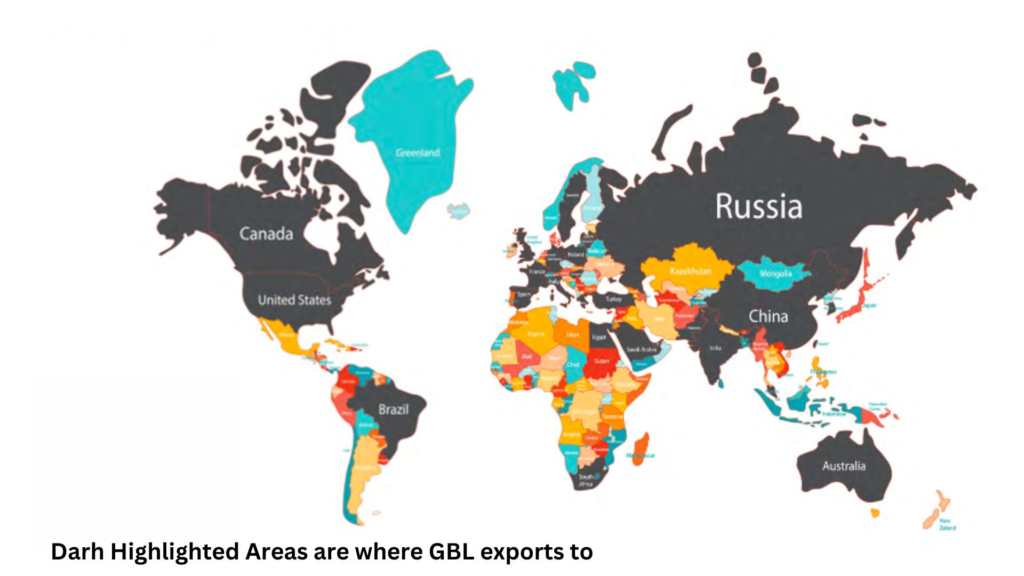

Galaxy Bearings Exports Customers (Geographically)

Capex

- Capex – In 2021, Galaxy Bearings announced a 35crs Capex to take the Total Installed capacity from 2.1 million Per annum to 9.6 million per annum, at the same time they will also invest in their R&D capability. Available land is 20,000 SQFT and 15,000 used for construction. This capex includes Grinding line for Tapered Roller bearings

- SmallRangeGrindingLine

- Medium Range Grinding line

- LargeGrindingLine

- Capacity per Month – 0.8 Million

- Capacity Per Year – 9.6

- Total Bearing Sizes/Month – 60 types

Product Development

- Galaxy Bearings has been able to consistently develop their bearings as per customer retirements. Case Study – Galaxy used to just make Tapered Roller bearings, Customers wanted the bearing with the hub, hence galaxy bearings, developed a Tapered roller bearing with the casting hub, before they had to buy bearings from Galaxy, and casting hubs from someone else, and assemble it on their own.

Warranty

- Warranty ranges from mostly 200,000 KM but GBL provides 500,000KM depending on the product and Customer. An average life of a truck (Commercial Vehicle) in KM is about 6,00,000KM – 800,000KM at best. On an average Bearings need to be replaced every 90,000KM to 100,000KM. Considering Galaxy bearings mostly provide 200,000KM warranty, in a life of 1 truck, bearings need to be replaced 2-3 times, hence replacement bearing market is big and a very important one.

Financials

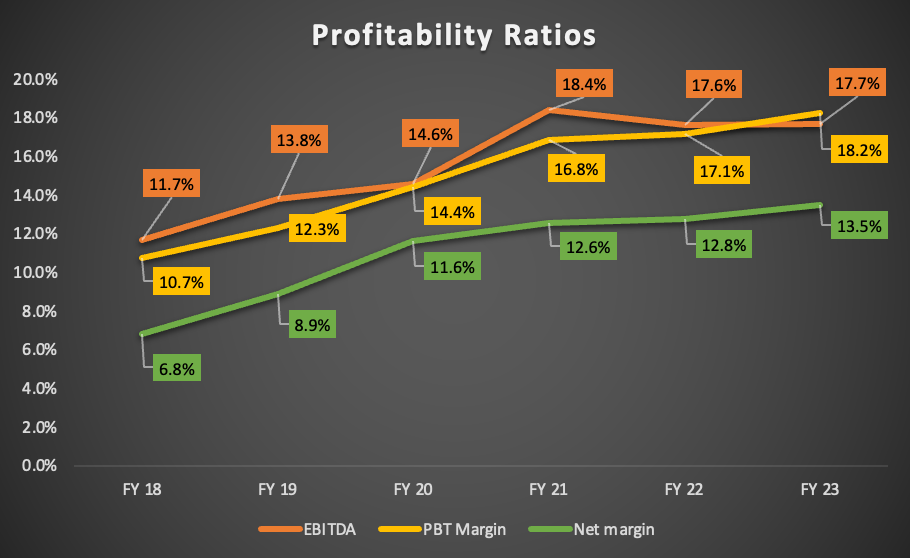

Margin profile

- Since 2018, Margins of GBL have shown a growing trend. EBITDA has increased from 11.7% to 17.7%, about 600 BPS increase. This can be attributed to increasing revenue from Export in the past years.

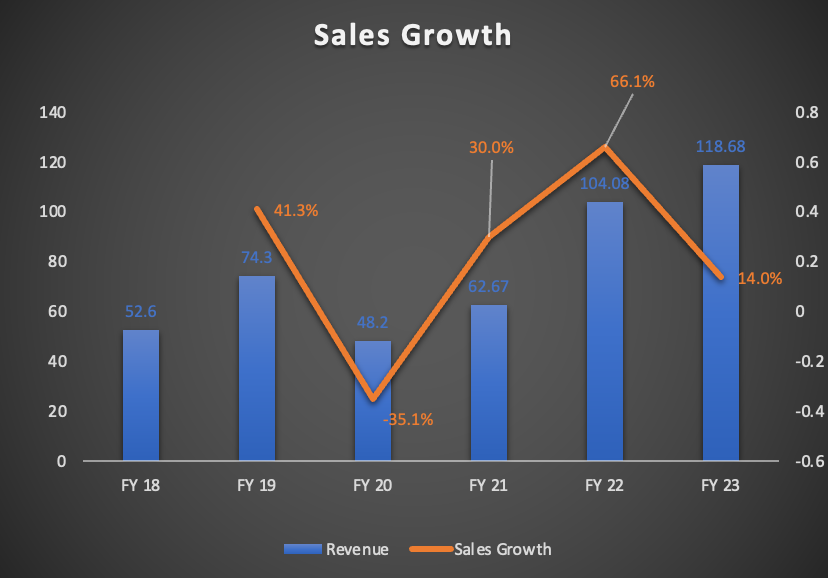

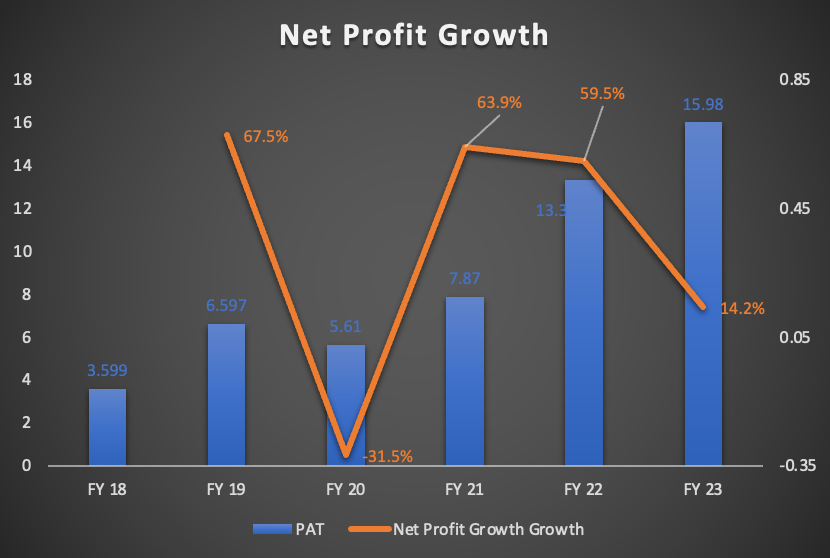

Sales and Profit Growth

- Galaxy Bearings has managed to grow sales and profits, very decently. Sales has compounded over 11% over 5 years, and Profits have compounded at 23%, result of margin expansion.

- FY 23 and FY 24 were difficult years for Bearing companies, but the growth momentum should continue considering the scope of growth being very big

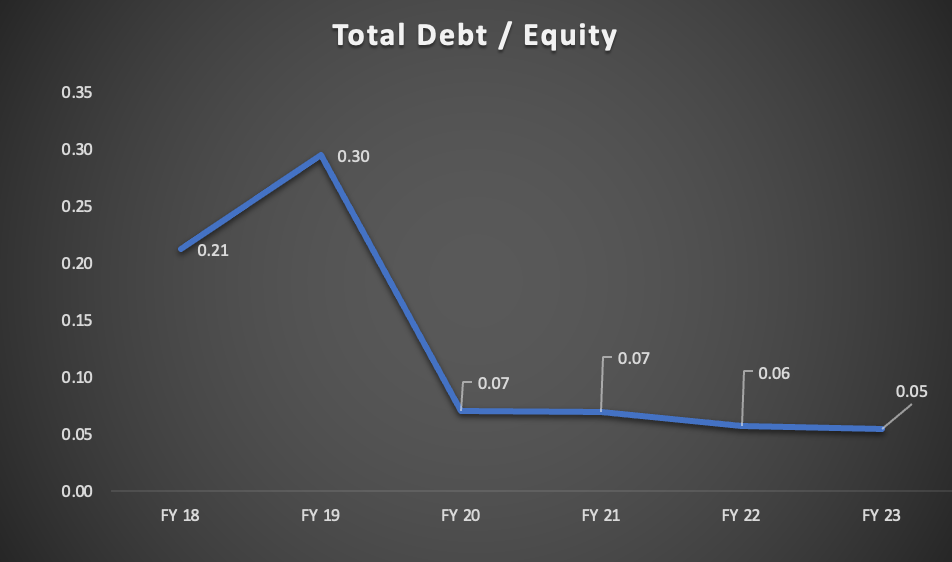

Debt to Equity Ratio

- Galaxy has managed to grow over the years, without taking any major debt. This shows the companies ability to use internal cash flows to fund growth

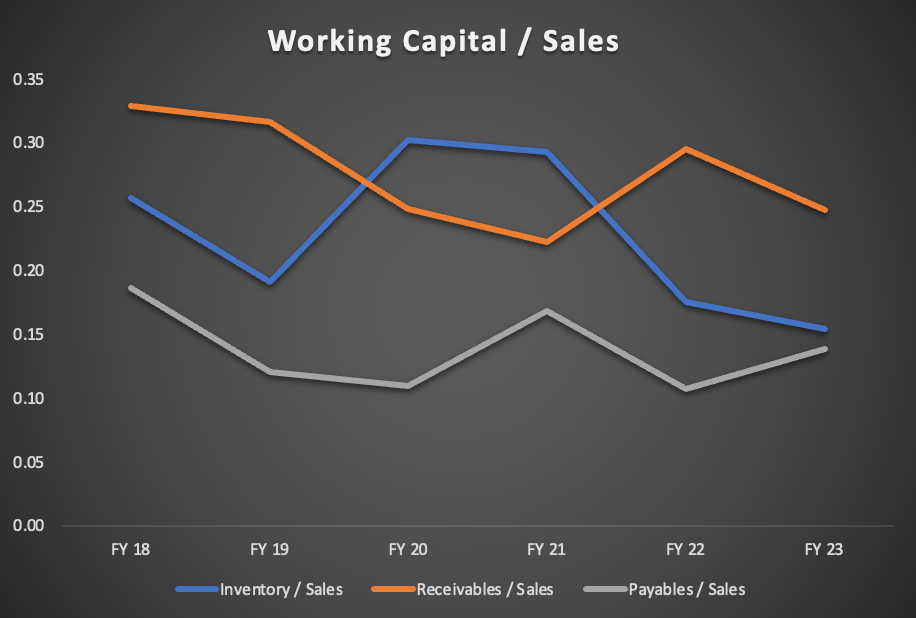

Working Capital

- Galaxy Bearing has managed to keep their working capital well in control, overall declining trend is seen in Inventory and receivables.

Competitor Analysis

| Sales Growth | FY 18 | FY 19 | FY 20 | FY 21 | FY 22 | FY 23 | FY 24 |

| NBR Bearings | 12.9% | -19.6% | -1.8% | 23.8% | 12.1% | 3.5% | |

| Menon Bearings | 19.2% | -20.1% | 7.2% | 32.9% | 10.6% | -5.9% | |

| Timkex | 35.0% | -2.8% | -12.7% | 56.1% | 27.4% | 3.7% | |

| Schaeffler | -4.4% | -13.7% | 47.8% | 23.5% | 5.2% | 2.2% | |

| Galaxy Bearings | 41.3% | -35.1% | 30.0% | 66.1% | 14.0% | 4.5% | |

| Profit Growth | FY 18 | FY 19 | FY 20 | FY 21 | FY 22 | FY 23 | FY 24 |

| NBR Bearings | 18.3% | -70.0% | 69.7% | 35.7% | 26.3% | 8.3% | |

| Menon Bearings | 19.0% | -44.0% | 35.7% | 31.6% | 32.0% | -21.2% | |

| Timkex | 62.0% | 65.1% | -41.9% | 128.7% | 19.6% | 0.3% | |

| Schaeffler | -12.4% | -20.9% | 116.2% | 39.7% | 3.4% | 0.9% | |

| Galaxy Bearings | 83.3% | -15.0% | 40.3% | 69.0% | 20.2% | 18.9% | |

| EBITDA Margin | FY 18 | FY 19 | FY 20 | FY 21 | FY 22 | FY 23 | FY 24 |

| NBR Bearings | 20% | 19% | 11% | 14% | 16% | 17% | 16% |

| Menon Bearings | 26% | 25% | 21% | 23% | 21% | 24% | 20% |

| Timkex | 12% | 17% | 22% | 18% | 23% | 20% | 20% |

| Schaeffler | 16% | 15% | 14% | 17% | 19% | 18% | 18% |

| Galaxy Bearings | 11.7% | 13.8% | 14.6% | 18.4% | 17.6% | 17.7% | 16.0% |

| Net Profit Margin | FY 18 | FY 19 | FY 20 | FY 21 | FY 22 | FY 23 | FY 24 |

| NBR Bearings | 10.9% | 11.4% | 4.3% | 7.3% | 8.1% | 9.1% | 9.5% |

| Menon Bearings | 14.4% | 14.4% | 10.1% | 12.8% | 12.6% | 15.1% | 12.6% |

| Timkex | 7.5% | 9.0% | 15.2% | 10.1% | 14.8% | 13.9% | 13.5% |

| Schaeffler | 9.2% | 8.4% | 7.7% | 11.3% | 12.8% | 12.6% | 12.4% |

| Galaxy Bearings | 6.8% | 8.9% | 11.6% | 12.6% | 12.8% | 13.5% | 15.3% |

| Cash Conversion Cycle | FY 18 | FY 19 | FY 20 | FY 21 | FY 22 | FY 23 | FY 24 |

| NBR Bearings | 152 | 237 | 266 | 215 | 275 | 292 | 338 |

| Menon Bearings | 115 | 120 | 144 | 135 | 129 | 121 | 140 |

| Timkex | 90 | 99 | 98 | 112 | 160 | 124 | 142 |

| Schaeffler | 76 | 82 | 59 | 68 | 66 | 74 | 0 |

| Galaxy Bearings | 173 | 164 | 246 | 181 | 158 | 102 | 163 |

- Galaxy Bearing being the smaller company compared to tots peers, has managed to fair very well with giants in the being industry.

- This not only shows good management and right strategy but also proves the product is right and they are going in the right direction.

- Sales growth for all look very flat, owing the FY24 being a particularly difficult year for bering manufacturers

Investment case

- In the past Galaxy Bearings has shown a great financial performance as well as capability to steer though rough times.

- Management has been instrumental for the growth, and can drive the growth ahead

- With 2x+ capacity coming in, future growth can be accelerated, with increased margin, from newer products, and entering newer geographies

- With the global infrastructure playing out, specially in India, this will help galaxy bearings going along

- With proven product and service in the export market, and increasing share form exports, margin will be stable, and can also increase going forward

- Galaxy Bearing being a small company and a growing one, it stands tall against giants in the bearing industry over long years, showing its resilience, high quality product and service

- Considering a decent split between OEM and replacement / Aftermarket, the risk of customer concentration comes down.

- GBL mainly exports to Germany, Italy, Turkey and UAE. This shows a decent mix, a slowdown in either geographies would not necessarily effect financials due to decent mix

Risks

- GBL is taking up a big Capex, almost 3x of existing installed capacity, If industry dynamics change when the capex is operational, it will be difficult for GBL to optimally use the capacity, and will take a toll on the financials

- GBL saw increased working capital in 2024, owning to raw material prices and slow down in the industry.

- GBL’s 75% of the revenue comes from export, which poses a risk of global slowdown

- GBL’s new capex will initially have front loaded costs, depreciation and other expenses, until the capacity starts running at optimum capacity

Disclaimer

Disclaimer: The information provided here is not a stock recommendation, tip, or financial advice. It is solely for informational and educational purposes. Prior to making any financial decisions, it is strongly advised to consult with a qualified financial expert.

Sources

- Company Website, Annual report, presentation

- International Journal of Advances in Engineering and Management (IJAEM) Volume 11

- SKP Annual Report

- Menon Bearing Annual Report

Regards,

Bhavya Sonawala.

Samaasa Capital