Investment Philosophy

These fundamental principles shape the core of Samaasa Capital’s investment philosophy. By adhering to these principles, we aim to build lasting wealth for ourselves while participating in the growth stories of the companies we invest in.

1. Embracing Long-Term Vision

a. At Samaasa Capital, we adopt a patient approach to investing. We seek out companies that are in the midst of a growth journey, companies that are evolving and expanding.

b. Instead of hopping from one investment to another, we commit to holding these companies in our portfolio for an extended period, typically 3 to 5 years.

c. This extended horizon allows us to truly understand the company’s potential and value, giving us a clearer picture of its growth trajectory and uncovering its genuine worth.

2. The Quest for Value

a. Building sustainable wealth requires a keen eye for value. We are dedicated to identifying companies that are not only promising but also reasonably priced.

b. Valuing a company is not a straightforward process; it involves considering a range of factors that can influence its worth, both positively and negatively.

c. Our investment philosophy emphasizes finding companies that offer an attractive balance between growth potential and their current valuation. We believe this balance is critical to long-term success.

3. Trusting in Passionate Leadership

a. We recognize that a company’s success hinges on the individuals at its helm. These leaders are the driving force behind a company’s growth and innovation.

b. To ensure our investments flourish, we actively seek out management teams that are not only skilled but also passionate about their business.

c. Passionate leaders tend to make well-informed decisions and steer their companies with integrity. Investing in businesses run by passionate and ethical leaders is central to our strategy as it fosters wealth creation and growth over time.

4. Prioritizing Financial Strength

a. In our investment journey, we prioritize companies with solid financial foundations. We have a preference for companies that maintain lower levels of debt, adhere to sound financial practices, and exhibit a track record of consistent performance.

b. The length of a company’s history is less important to us than its financial health. Clean

financials and responsible fiscal management instill confidence in our investments, reducing

the risk associated with our portfolio.

Latest Articles

Tariffs, Tensions, and Trade Wars: The Global Chessboard in Motion

Understanding the First and Second-Order Effects of Tariffs First-Order Effects of Tariffs: The Direct Impact At their core, tariffs are taxes on imports. But their

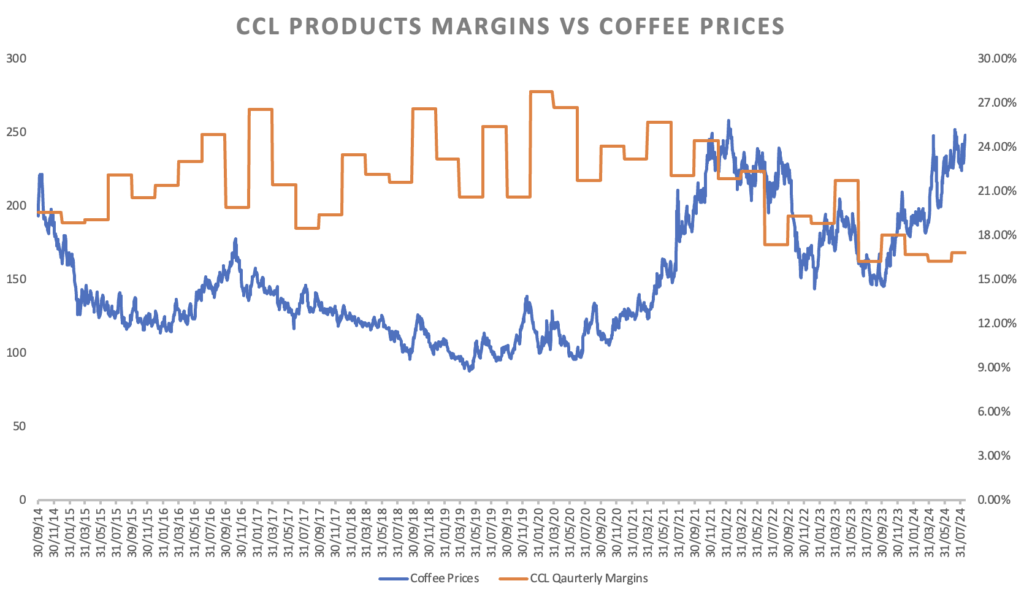

Case Study – Price + Model

Have been Invested and studying CCL Products for a while. They have been mentioning how their margins look low / suppressed optically, when coffee prices

Exploring Galaxy Bearing Limited

About the Company Bearing Industry Indian Bearing Market More on Galaxy Bearings Applications of Galaxy Bearings Products Plant Revenue Split between Domestic / Export and

India: The Emerging Global Superpower

As the world economy navigates through uncertain times, India has emerged as a beacon of stability and growth, cementing its position as the next global

One of the many lessons from the Markets

In May 2020, I started researching Tata Consumer Products (formerly Tata Global Beverages), diving deep into its intricacies. Several aspects caught my attention: Expanding Distribution

Brewing Success: Unveiling the Essence of CCL Products Limited

Industry Overview Consumer Trends in Coffee Market Instant Coffee growth Triggers CCL Products (Continental Coffee) Capacity Insights Management (KMP) Snippets Raw Material and Relevant Issues