As you embark on your investment journey, the question of where to invest can be overwhelming. Financial planners often stress the significance of initiating early steps and constructing a robust equity portfolio. In this article, we’ll explore compelling reasons why integrating equity exposure into your portfolio is essential and how it can pave the way for achieving your financial goals with ease.

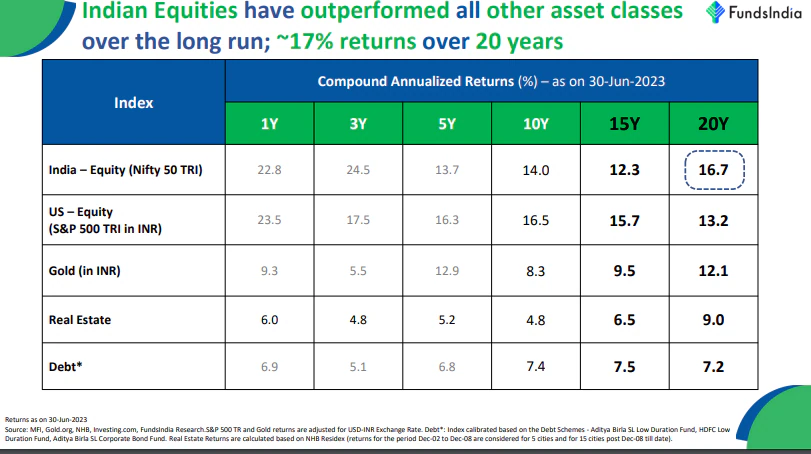

1. Equity’s Long-Term Triumph:

Statistically, equity has proven to be the top-performing asset class over extended periods. Take, for instance, the remarkable journey of Nifty. If you had invested a lump sum on January 1, 2000, the annualized return of 15.5% could have significantly propelled your wealth creation goals, surpassing other asset classes like debt, real estate, and gold.

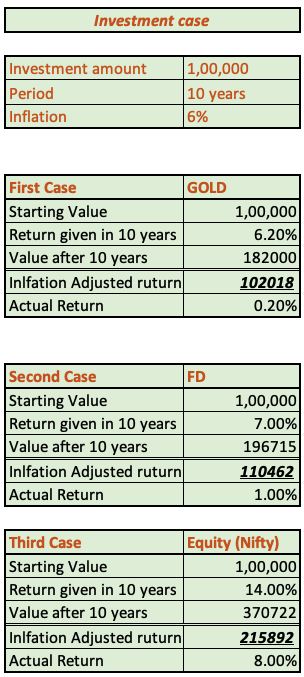

2. Surpassing the Inflation Hurdle:

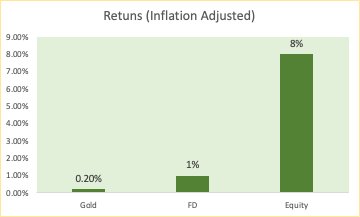

India’s historical moderate to high inflation has silently eroded the wealth of investors relying solely on fixed income. To combat this, prudent investors consider “real” returns—nominal return minus inflation. Choosing equity over a fixed deposit with a 5% after-tax return when inflation is at 6% ensures your wealth doesn’t diminish but grows. Looking at the below table and chart, there’s a clear winner: Equities. Not only beating inflation but also generating significant better returns than the most invested asset classes: Gold and FD’s.

3. The Magic of Compounding with Equity:

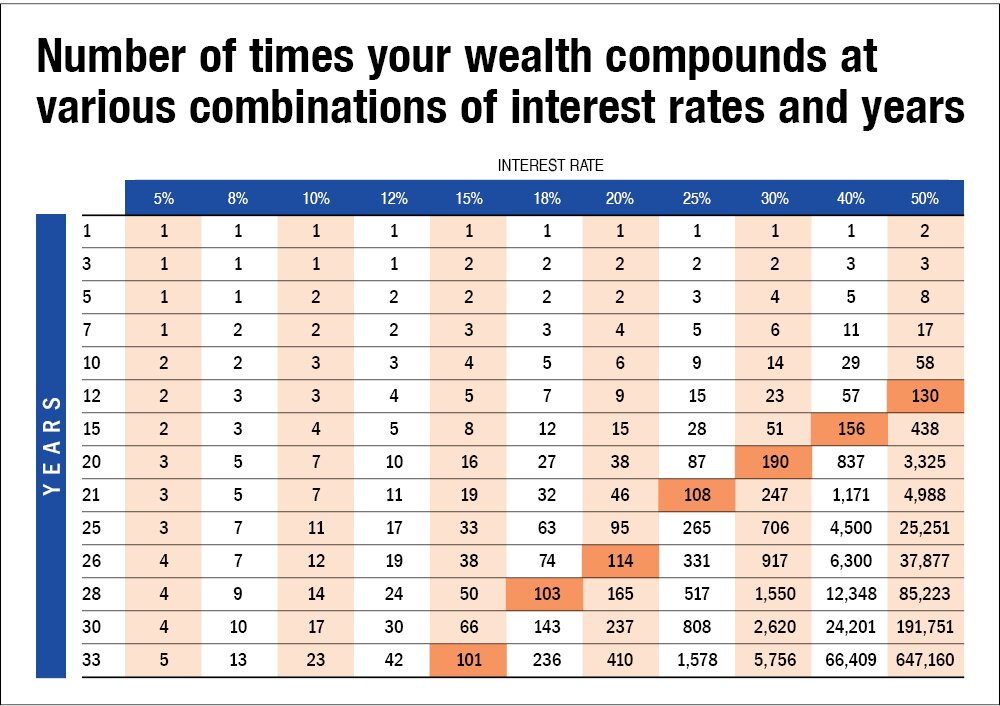

As Albert Einstein famously stated, compounding is the eighth wonder of the world. Higher returns from equity, compounded over time, magnify the benefits. For instance, investing Rs. 5,000 monthly for 25 years in an 8% fixed deposit generates Rs. 47.55 lakhs. Conversely, an equal investment into equity (let’s say Nifty) with a 15% annualized return creates a whopping corpus of Rs. 1.62 crores—3.4x more than the fixed deposit returns. In the below chart, just by taking a conservative number, if stay invested for 10 years at an average return of 15%, your wealth will compound 4 times! This is the power of Compounding.

4. Starting Small, Achieving Big with Equity:

Equity’s beauty lies in its accessibility for small-scale investors. Due to the extended investment horizon, the amount needed to achieve financial goals is relatively modest. Consider you want to invest every month and have a target of 1 crore over 10 years. If you consider investing a fixed Deposit with a return of 7%, your monthly investment into an FD will need to be Rs. 57,000/-, and if you were to invest in Equities considering a nominal return on 14%, you would just need to invest Rs. 38,000.

Conclusion:

While equities may show short-term fluctuations and carry more risk than other investments, constructing a well- rounded portfolio positions them as the primary asset class for achieving long-term financial objectives. The key lies in commencing your investment journey early, adopting a systematic approach, and maintaining a prolonged investment horizon. Additionally, diversification plays a crucial role. By spreading investments across multiple asset classes, you can attain favorable returns while keeping risks in check. This article aims to elucidate the rationale behind favoring equities and underscores the importance of a substantial exposure to equity markets, unlocking their potential to amass wealth and ensure financial security.

Regards,

Bhavya Sonawala

-End-

Sources:

Funds India

Value Research

Economic Times