As a value investor, I believe that everything ultimately reverts to mean, including stock prices and valuations. The principle of reverting to mean suggests that when something moves too far away from its historical average, it will eventually move back toward that average. In the context of investing, it means that stocks that are overvalued will eventually decline, and those that are undervalued will eventually rise.

The principle of reverting to mean holds true for both earnings growth and P/E growth. Earnings growth is simply the company growing its profits. However, many people forget that the perception of the company reflected in the Price to Earnings (P/E) ratio plays an equally important role in determining its stock price. A company with extremely high valuations cannot sustain at those levels and will eventually revert to its mean, and vice versa. A company with low valuations and decent earnings growth will also see its perception or P/E ratio rise over time, again reverting to mean.

Trying to time the market at the bottom and top is nearly impossible. Instead, as a value investor, I follow the Systematic Investment Plan (SIP) approach, investing at attractive valuations and selling using the same SIP method when valuations are expensive. This allows me to average out the cost of investment, reducing the impact of any short-term volatility in the stock price.

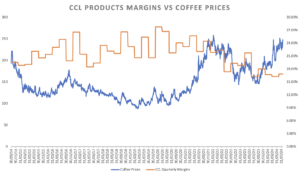

It’s important to note that if a company has had supernormal profits for one or two years, the next few years may see average or subpar returns as the stock price reverts to its mean. However, finding companies currently in a sideways market is difficult. At Samaasa Capital, we look for companies where demand has fallen, but new capacities are in place, and management feels that demand will recover. Finding such companies at cheap valuations is what we believe will do well in the long term.

It’s normal for companies to have drawdowns and a few bad quarters. Even companies’ financials are subject to the principle of reverting to mean. After the COVID-19 pandemic, we saw companies grow disproportionately in earnings and stock prices. Therefore, a few months or a year of sideways or low growth in stocks seems normal.

At Samaasa Capital, we believe in sticking to good companies and having enough conviction to ride out a few bad quarters. As value investors, we believe in the power of the principle of reverting to mean as well as waiting for the right value and use it to our advantage when making investment decisions.

Remember, investing is not a sprint, it’s a marathon. By focusing on the fundamental principles of investing and having patience and conviction.

Please do share your feedback

Regards,

Bhavya Sonawala

Samaasa Capital

Disclaimer – This is in no way a advice, tip or recommendation of a stock or investing method